Getty Images

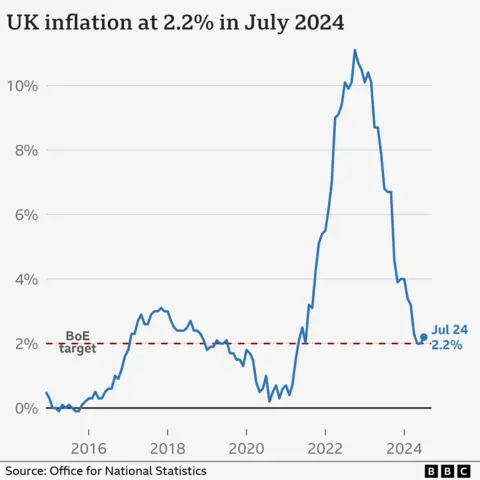

Getty ImagesThe UK’s inflation rate has risen for the first time this year, official figures show.

It means overall prices rose by 2.2% in the year to July, up from 2% in June, surpassing the Bank of England’s target.

However, an increase was widely predicted and is largely due to prices of gas and electricity falling by less than they did a year before.

The Bank expects inflation to rise further this year before falling back again.

Grant Fitzner, chief economist at the Office for National Statistics (ONS), said: “Inflation ticked up a little in July as although domestic energy costs fell, they fell by less than a year ago.

“This was partially offset by hotel costs, which fell in July after strong growth in June.”

Inflation, which measures the rate at which prices rise, surged to 11.1% in the wake of the Ukraine war and pandemic-related supply chain crunches, driving up the cost of living for millions.

But it had been steadily falling until June, as the Bank of England increased interest rates to dampen consumer demand.

Mr Fitzner told the BBC’s Today programme that “under the bonnet” price rises remained under control, with services inflation down in July and food prices unchanged.

“This still suggests that inflation pressures at least in the short run are fairly moderate,” he said.

According to the Institute for Fiscal Studies think tank, food and drink prices surged by 28.4% between September 2021 and September 2023.

Its latest analysis suggested that less well-off households saw their food bill rise by far more than those with higher incomes, as the sharpest price increases had been applied to cheaper brands.

But in July, food price inflation had settled down to just 1.5%, according to the ONS.

Meanwhile, price rises in the important services sector – which includes things like hotel stays, gym subscriptions and car repairs – have started to edge down.

Services inflation in July stood at 5.2% – down from 5.7% in June and 7.4% in July 2023, which was the joint highest rate for more than 30 years.

Interest rate decision

The Bank of England is likely to factor in July’s rise in the overall inflation rate when it next votes on interest rates in September.

Last month, it cut rates to 5% from 5.25% – the first reduction since the start of the pandemic – and experts have been predicting further cuts this year.

Higher rates are good for savers but drive up the cost of mortgages and other loans for consumers.

Darren Jones, chief secretary to the Treasury, said that the new Labour government is “under no illusion” about the challenges still facing households.

Shadow chancellor Jeremy Hunt said that the new figures show that there is “more to be done to keep inflation down”.