[ad_1]

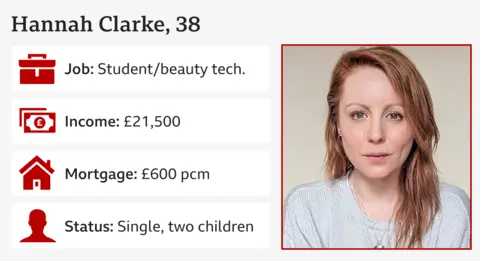

Hannah Clarke

Hannah ClarkeChancellor Rachel Reeves has unveiled Labour’s first Budget for 14 years and it was jam-packed with announcements on how much tax each of us will pay and how much the government will spend on public services.

BBC News has been speaking to people with a range of incomes about what they wanted from the Budget and what they made of it.

If there are issues you would like to see covered, you can get in touch via Your Voice, Your BBC News.

Hannah Clarke

Hannah ClarkeMum-of-two Hannah Clarke from Rutland in the East Midlands was juggling two part-time jobs but recently started studying full-time for a midwifery degree. She also works six to eight hours a week as a self-employed beauty technician.

Hannah takes home about £1,800 a month, mostly via a student loan which she doesn’t pay tax on. She says this just about covers her mortgage payments, as well as bills and fuel.

She watched the entire 77-minute Budget between lectures and is relieved that the freeze on fuel duty will stay in place.

“I have to drive to uni every day so that was brilliant to hear.”

She says that overall, the Budget gave her “glimmers of hope”.

She is glad that the freeze on income tax thresholds will end in 2028, as this will be around the time she graduates.

But she adds she was a bit disappointed that Reeves did not announce anything to tackle the issue of pay for NHS workers.

“I would have loved to have seen [something like] funding for NHS degrees for things like nursing and midwifery, where your fees are paid if you work for the NHS for a certain number of years.

“So many more people, especially mature students, could go to uni that way.”

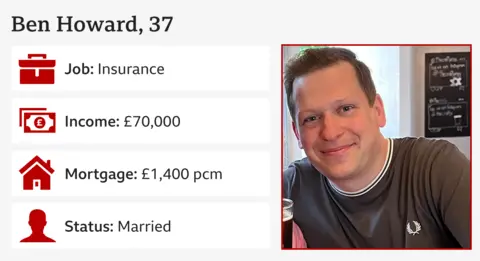

‘We make £100,000. We’re not worse off because of the Budget’

Ben Howard and his wife Sarah from Bristol are expecting their first child in February. They have a joint income of £100,000. In September, their mortgage repayments went up by 60% to £1,400.

Ben was expecting to be worse off after the Budget, but says: “I actually don’t hate it.

“There is a deficit that needs to be plugged and [the Budget] has some smart ways to do that.”

But with the rise in National Insurance employer contributions and the minimum wage, he wonders what the changes for business will mean for “jobs and [career] prospects and promotions”.

With a baby on the way, he was a bit disappointed that there were no allocations for childcare.

“There are fewer babies being born and right now there aren’t any incentives to have kids. But people on low incomes needed a boost, so as long as they [the government] stick to their word, we’re happy.”

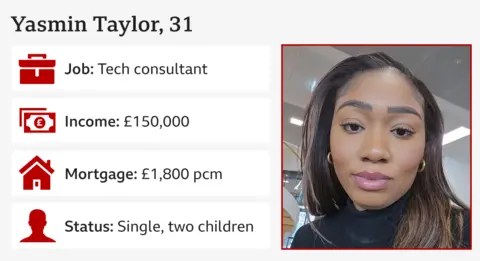

‘I make £7,600 a month. It’s right to add VAT to private school fees’

Yasmin Taylor from Kent is a tech consultant and single mother of two young children.

She says she is “50% happy” with the Budget and agrees with three things that Rachel Reeves announced.

Given Yasmin’s biggest outgoing is £2,600 per month on childcare, she welcomes the tripling of investment in breakfast clubs in schools across the country, as well as the rise in the minimum wage – as she believes it could incentivise a lot of nursery workers to stay in the sector.

And although her children will go to a private school and she is likely to face higher costs when VAT is added to private school fees next year, she thinks it was the right decision by the chancellor.

“When she explained what the VAT on private school fees would be spent on – that it would go towards state schools – I thought that would be quite good.

“Anything that helps encourage upwards social mobility is a good thing,” says Yasmin, adding she is from a working-class background.

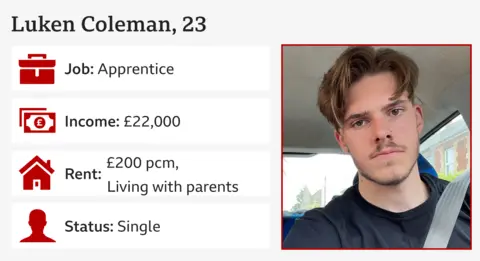

‘I earn £1,500 a month. The apprentice wage rise is a good thing but won’t affect me’

Luken Coleman works as a Level 3 business administration apprentice for a recruitment agency, earning about £1,500 a month. Previously he worked in shops and in manual labour jobs.

He works full-time Monday to Friday and goes to college one day a month.

Luken lives in Newbury with his parents and pays them £200 a month rent. While he pays all his own bills, he cannot afford to move out.

“The average rent where I live is between £700 to £900 per month. If I did move out, I’d have to move further away, so I’d need a car.”

As someone nearing his mid-20s, he says it can feel like you’re not achieving much when you are still living at home.

“It’s a mental health thing. Money-wise, apprentices are paid less because you are learning on the job, but it can make you feel less about yourself when you are not fully independent.”

The chancellor confirmed the minimum hourly pay rate for apprentices will go up in April, which Luken says broadly speaking is a good thing but his apprenticeship is due to end in December so the change won’t affect him.

When his apprenticeship ends he is hoping to be kept on by his company, but is open to other opportunities.

‘I make £1,920 a month. Long-term I’ll be hit by inheritance tax and pension changes’

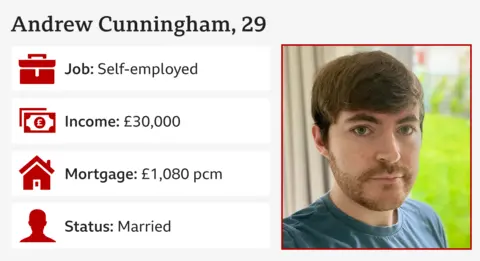

Blogger and web developer Andrew Cunningham lives with his husband in Glasgow. He describes themselves as “middle earners but diligent savers” who have been investing in their individual savings accounts (ISAs) and their pensions to fund their retirement.

He is relieved there were no changes made to the amount of money you can hold tax-free in an ISA or to pension tax relief, as had been rumoured ahead of the Budget.

However, from 2027 pension pots passed on to loved ones will be subject to inheritance tax, which Andrew believes will have a “massive impact on family tax planning”.

“It won’t discourage me or my husband from saving into our pensions but it will have an effect on our long-term plan.

“We want to have children at some point and making sure the amount we eventually pass down is done so in the most tax-efficient way possible is a priority for us.

‘I get £1,590 a month. The minimum wage needs to go up by more’

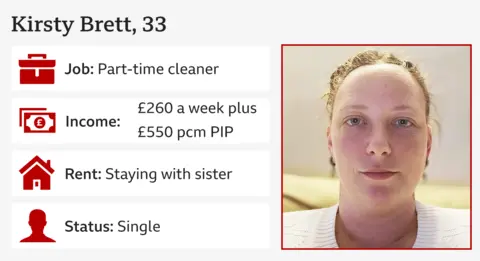

Kirsty Brett works part-time as a cleaner in a care home, earning the minimum wage of £11.44 an hour.

She recently moved in with her sister in Bury St Edmunds in Suffolk while she looks for new accommodation, after leaving her old job as a carer in Essex.

Kirsty has osteoporosis, which made her work difficult, and also found it too expensive living in Essex. She receives £550 a month in Personal Independent Payments.

She appreciates the chancellor raising the National Living Wage to £12.21 in April, but is disappointed it’s not a bigger increase.

“That is not even £1 more. Everyone will appreciate it but it will not make a difference to people because of the cost of living.

“People should be paid at least £15 an hour. That would help a lot of people.

“The wage they class as minimum wage – I don’t see how it sustains someone.”

The Budget also included a £500m boost in funding for the Affordable Homes Programme, but Kirsty would like more clarity on what counts as “affordable” as it could mean different things to different people.

She is currently looking at “the cheapest options” for somewhere to live. She says she’s found renting a one-bedroom flat costs about £1,300 a month, so Kirsty is instead looking at renting a caravan for around £800 a month.

‘I get £2,750 in benefits. Possible welfare reforms are concerning’

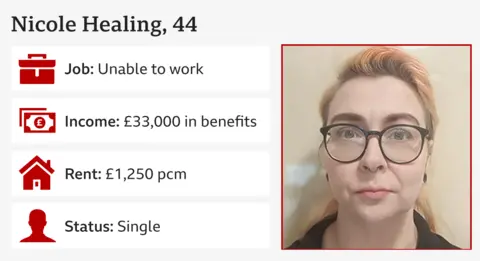

Nicole Healing rents a one-bed flat in Brighton for £1,250 a month.

Nicole previously worked as a civil servant and in digital marketing, but hasn’t been able to work for the last few years due to several disabilities, including a connective tissue disorder that causes their joints to dislocate.

Nicole receives Employment and Support Allowance of £1,042 which includes the severe disability premium, Personal Independent Payment of £798, and Housing Benefit of £917 per month.

In the Budget, the chancellor said there would be a widespread review of health and disability benefits, which Nicole says is “very concerning”.

“Because you’re going on the proviso that if you have mobility issues you can just work from home – that’s very oversimplified. There are lots of reasons why you might have mobility issues that might impede your ability to work.”

Nicole believes a different approach is needed. “You have to incentivise employers to make accommodations for people – whether that’s flexible working or getting the right items you need.

“The government is saying invest, invest, invest. Well invest in people and businesses – you’re going to get more productivity.”

Some people cannot work though, Nicole says, adding: “Everyone, whether in work or not, should be entitled to a decent standard of living, autonomy and dignity.”

‘My pension is £1,200 a month. This Budget won’t change anything for me’

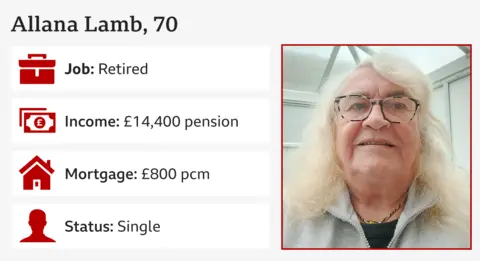

Allana Lamb from Torquay is an army and navy veteran and a retired social worker. She is a couple of pounds over the threshold for pension credit so she will not get the winter fuel payment this year.

Allana gets both the full state pension and a small army pension, totalling £1,200 a month, which she says doesn’t cover all of her outgoings. She also expects her mortgage to “virtually double” in the next few years.

She believes the Budget won’t change anything for her financially, and says it was a “missed opportunity” by the chancellor to make higher earners pay their fair share. She is unhappy that the top income tax rate of 45% was not increased.

She welcomes workers “getting more money in their pocket” as a result of the rise in the minimum wage, but says it would come at the expense of businesses, especially smaller ones, that are already struggling in her home town.

“Torquay’s dead,” she says, referring to the number of shops on the town’s High street that have closed recently. “And no businesses are moving in to replace them.”

She is glad that fuel duty was not raised. “I filled up yesterday, just in case.”

But she is concerned about changes to inheritance tax rules.

“My kids will get walloped for inheritance tax when I’m gone,” she says.

[ad_2]

Source link