[ad_1]

Getty Images

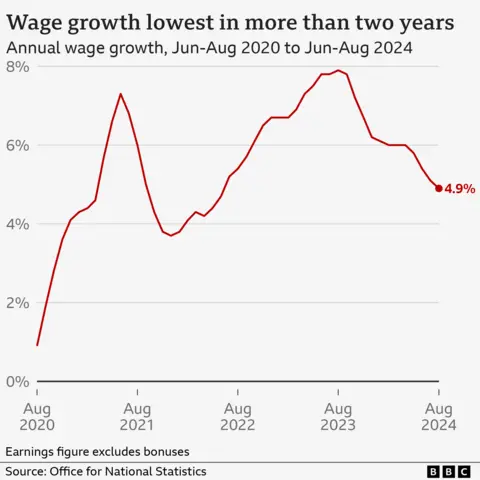

Getty ImagesExpectations that UK interest rates will be cut in November have risen after wage growth slowed to its lowest pace for more than two years.

Pay grew at 4.9% between June and August, official statistics show, down from 5.1% previously.

The figures have added to widespread expectations that UK interest rates could be cut to 4.75% when the Bank of England meets next month.

Pay is still rising faster than inflation – which measures the rate of price increases – but analysts do not expect that to delay any rate cut plans by the Bank.

Yael Selfin, chief economist at KPMG UK, said the “encouraging” figures on wages plus slowing economic growth meant she expected the Bank of England to reduce borrowing costs from 5%.

In the last set of jobs numbers before the Budget, the Office for National Statistics (ONS) said the unemployment rate fell to 4%.

However, Ashley Webb, UK economist at Capital Economics, said this “isn’t a sign that employment is booming”.

The ONS has urged caution with its unemployment figures due to problems with the survey data it collects. But it said that an alternative measure shows a flattening off of the number of employees on payrolls in recent months.

Employers are continuing to grapple with higher costs, and reports have suggested they are wary of making any big moves ahead of hearing more about the chancellor’s tax plans in the Budget on 30 October.

Toby Fowlston, chief executive of recruitment company Robert Walters, told the BBC there was currently a “lack of confidence” in hiring.

He said this was due to a number of reasons, including the forthcoming Budget, the proposals for workers’ rights in the Employment Rights Bill and the increase in the minimum wage.

The ONS said the rate of people considered “economically inactive” – defined as those aged between 16 to 64 years old not in work or looking for a job – edged lower to 21.8%.

The number of job vacancies also decreased, falling to 841,000 in the July to September period.

“Vacancies have fallen once more, with most industries seeing a fall on the quarter,” said David Freeman of the ONS.

“However, the total still remains a little above its pre-pandemic level.”

Tips for getting a pay rise

- Choose the right time – Scheduling a talk in advance will allow you and your boss time to prepare, and means you’re more likely to have a productive conversation

- Bring evidence – have a list of what you’ve achieved at work and how you’ve developed yourself

- Be confident – Know your worth and don’t be shy about speaking up

- Have a figure in mind – look at job adverts online to see the salaries for comparable jobs

- Don’t give up – keep talking to your employer if it doesn’t work this time and if you can’t get what you want be prepared to look elsewhere

[ad_2]

Source link