[ad_1]

Getty Images

Getty ImagesUK banks must refund fraud victims up to £85,000 within five days under new rules.

Most High Street banks and payment companies voluntarily compensate customers who are tricked into sending money to scammers.

But in a world first, these refunds will become mandatory from 7 October, the Payment Systems Regulator (PSR) has announced.

The watchdog has reduced the maximum compensation from a previous proposal of £415,000. It said the new cap of £85,000 would cover more than 99% of claims.

It also announced that once a bank or payment company had refunded a customer, it could claim half back from the financial institution the fraudster used to receive the stolen money.

But consumer champion Which? warned there could be “disastrous consequences” as a result of lowering the cap and called on the regulator to monitor any impact.

When criminals dupe their victims into sending them money by pretending to be a legitimate company, such as their bank or a tradesperson or by selling goods that do not exist, this is known as authorised push payment fraud (APP).

The number of cases of this type of fraud rose by 12% to 232,429 in 2023, with losses totalling £459.7m, according to UK Finance.

There is currently no requirement for banks to refund victims of APP fraud, but these new rules will change that from next month.

The maximum refund was slashed after objections from the financial industry that it could cause problems for smaller firms.

Out of more than 250,000 cases in 2023, there were 18 instances of people being scammed for more than £415,000, and 411 instances where they lost more than £85,000, the PSR said.

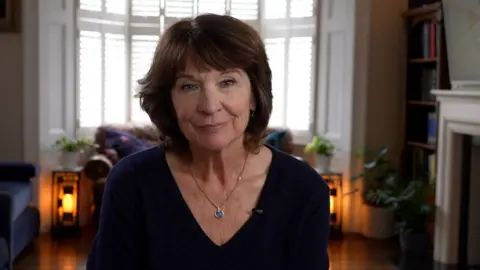

Carol Alexander, a lecturer in Financial Markets, was tricked into downloading software that gave fraudsters access to two of her bank accounts. They then stole nearly £80,000.

“They emptied everything that they had transferred from Santander and everything from Tide,” she told the BBC.

“I collapsed, it was so awful. I felt I had colluded. It was like some sort of coercive control thing, it was horrible,” she said.

Mrs Alexander managed to get a full refund from Santander, which returned £17,000 to her the next day. But it took nearly 18 months for her to get her money back from online bank, Tide.

“They initially offered to refund me £13.12 after having £63,000 removed from my account, they said that was all they had been able to recover. I nearly fell off my chair.”

She eventually went to the Financial Ombudsman Service, which ruled in her favour and ordered Tide to refund her the full amount, plus interest.

A spokesperson for Tide said: “We’re always enhancing our systems to keep up with the complex and evolving tactics used by fraudsters who maliciously target our members, and since Mrs Alexander’s case we have further improved our fraud prevention, detection and response capabilities.”

‘Game-changer’

David Geale, managing director of PSR said the new rules would mean all victims of this type of fraud would now get the same level of help.

“Whether you get reimbursed and how much can actually depend on who you bank with and that can’t be right,” he said. “We want to have a consistent experience.”

He said claiming half the compensation back from the bank the fraudster used would be a “game-changer” because it would incentivise the industry to shut down accounts sooner to prevent fraud and therefore payouts.

Asked whether smaller banks could get into financial trouble if they have to pay out lots of large refunds he said: “If they can prevent this happening then they haven’t got a bill to pay.”

But Rocio Concha, Which? director of policy and advocacy, said lowering the proposed reimbursement would reduce the incentives for banks and payments firms to take fraud prevention seriously”.

“The regulator has shamefully sidelined scam victims, despite the evidence showing that this decision could have a negative financial and psychological impact on them,” she added.

What are your rights if you are a victim of fraud?

- The Financial Conduct Authority regulates financial services in the UK

- Customers can complain about any regulated firm to the Financial Ombudsman Service, which can settle disputes and order firms to pay compensation

- Most High Street banks have signed up to the Contingent Reimbursement Model code designed to protect customers from authorised push payment (APP) scams

- The CRM will be superseded by the Mandatory Reimbursement Requirement from 7 October 2024

- Unlike the CRM, which is a voluntary code, the new regulations are obligatory

- They will cover the vast majority of UK money transfers up to £85,000, with the exception of international transfers or those involving cryptocurrencies

- Refunds will be split 50-50 between sending and receiving firms

[ad_2]

Source link